As stated in previous blogs ‘finance’ is the practice of settling debts. In these modern times most debts are paid with currency or money. Now in order to become debt free and in time wealthy we must figure out how to efficiently earn money in this system. Here is your guide for types of income and examples of each, followed by best practices for maximizing income.

1. Active Income

The first is active income which is also the most common type. It is also called time for money and involves a very unequal exchange. This is where you trade in your precious, limited, non-renewable and priceless time for money. This includes your hourly, weekly, biweekly, monthly, yearly salaries. Most people stay here and try to work harder or spend more time to earn money because it is all that is known, all that is taught, all that we were conditioned to accept. It is also difficult to realize what is happening financially when there is a nicer trap with more bells and whistles, like a promotion or higher salary waiting. Everyone around you is working for it and when you get it, it feels great. For a moment you can almost believe you are fulfilling your purpose but you know better. From the moment we were able to understand the world we were forced to be in classrooms learning lessons that the majority aren’t interested in. Now before we jump to conclusions, I am all for education, I’m currently getting my doctorate, but most people realize much too late that their education was more about contributing to someone else’s purpose while neglecting their own. “But school is important because it teaches discipline and encourages learning”, I always hear them say, and while both are true the pipeline for schools lead directly to companies that underpay workers and run monopolies and oligopolies that stifles those who may be more self-sufficient in many countries, often scaring them into thinking that the security of living paycheck to paycheck makes more sense.

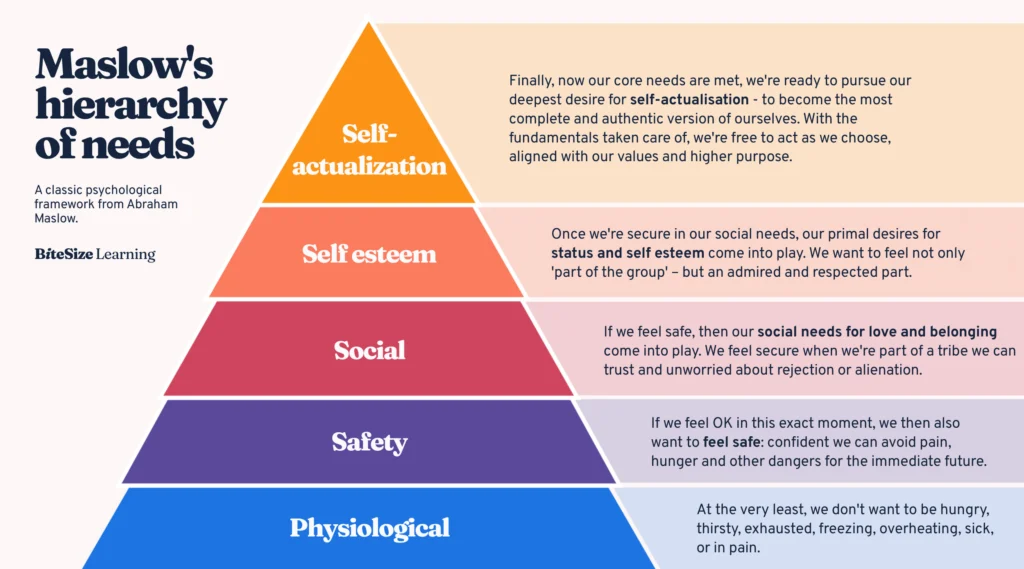

However, I am in the USA so there are a lot of opportunities to do something different and while I believe active income is necessary and should be taken advantage of, especially to provide security in more dire situations, it is not a sole solution. It cannot be. Time is far too valuable and men have killed for far less. It needs to be used with other income types, else it becomes difficult to stay fulfilled and be able to do the things you want to do. Also here is another quick fact to help shift perception. Self actualization and using your full potential is widely considered by the majority of psychology and social scholars as a NEED not something that should just be put on hold indefinitely. It is at the top of Maslow’s hierarchy of NEEDS and affects you more than you may think.

Your dreams matter, and should not end when you wake up…. That’s the magic. #motivational. I’m not a psychologist or anything though so I’ll get back to the business of the matter.

2. Product Based Income

This is income from selling a tangible item. It often involves refining, manufacturing, processing, packaging, building, publishing, printing etc. While it does require time to be spent it is often scalable. Managing time in the creation process and establishing proper distribution and marketing for the said product is very important as well. The main thing you’d want to focus on in this area is being able to compete against similar products. How you wish to compete here is really up to you. That is part of the beauty of the industry. You can focus on creating a superior product, make something more efficient, one that addresses consumer needs better, one that is cheaper, one that is more luxurious, more durable, more fashionable, more portable, more relatable, safer, cleaner, elitist, for the culture, healthier, I mean you get it. The possibilities are endless. So when you tell your friend you are thinking of selling a product and they respond with everybody and they mama selling that, or no one would buy that from you when there’s a huge corporation making the same thing, you then have to figure out how to compete by doing things these companies are either not willing to do or cannot do. Adding customization to a product is something most larger companies overlook and sometimes entire countries or even demographics right here in the land of the free don’t have access to particular products.

3. Digital Product Based Income

Digital products only need to be created one time then the content is accessible after the customer purchases. Time is invested upfront then revenue scales independent of time. This is one of my favorite types of income because you can set it and forget it, then remember it when that ACH hits your account, just kidding. Examples of some digital products include ebooks, templates, software, apps and online courses. Digital products typically require digital and targeted marketing to be successful. Understanding the user experience can make a big difference. Easy navigation and pleasurable graphics can do a lot in terms of customer satisfaction, return customers and getting referrals. The internet already has a lot of data available. Making that data easy to edify, easy to understand, accessible or adding your own experience or expertise to guide consumers on complex or niche matters is something you CAN do! If you have programming skills simple solution applications can be very successful as well.

4. Service Based Income

This is also known as professional income or fee for service. This can be defined as income earned by performing a service that is generally customized by the client. This is more scalable than active income but still heavily influenced by time. Some examples of service based income are coaching packages, legal or financial services, agency retainer, consultations, food as a service, hair, nails, massages, healthcare and things along these lines. This works well when you have licenses or qualifications that limit just anyone from being able to offer the same service. If you like most people only make active income, consider adding a license in a similar or complimentary field to boost your income. But be intentional and actually market yourself, when you have a professional license you are the expert. Don’t just let your licenses collect dust and be an unnecessary expense though. You can learn to be sales oriented!!!

5. Royalty Income

This is income earned from the ongoing use of certain assets that were created once. The key characteristic of this income is that you are paid per use, stream, play or license and not by the time you initially put in. It is very similar to digital products but is more specific. Some examples are music streaming, book/audiobook, film/tv licensing, stock photography, patents, trademarks and more. This succeeds at greater scale when there are more people willing use the product. Creating cultural bonds for the long term and tying the products to social interaction and trend in the short term, make royalties some of the best ways to earn income as that income can span generations when done right. Look for opportunities to create creativity, conversation and core memories. Shake it up and change the norm!

6. Residual Income

Many business ‘gurus’ like to conflate this term with passive income which is very different. Don’t listen to them, listen to me. Residual income continues after work is completed, it is tied to previous efforts. Some examples of this are commissions, overrides, subscriptions and memberships. This is good because it stacks so the more you convert the less stress you have as the focus then becomes keeping the clients and maintaining expectations. This is usually easier than getting a client initially. This income gives a predictable recurring positive cashflow that requires less time than strictly service or product income as described above.

7. Passive Income

True passive income is very rare because the system isn’t made for those without a lot of resources to typically have access to passive income. Passive income is earned with little to no ongoing effort after setup. This contributes to time freedom and scales with capital therefore compounding gains. It is ideal for long term wealth building. The downside of this is the heavy starting capital and high-risk exposure. It also does not build very quickly in early stage due to not compounding yet. Examples of passive income are dividends, interest income, rental income when you are not managing the property, REITs and automated businesses. With passive income the natural movement of money is taken advantage of rather than using time. When you have a lot of money and you know where to put it helps incubate economic activity and increases the value of your asset. This steers your assets (money) away from the dangers of inflation (depreciation of currency) towards growth, gains and wealth.

8. Portfolio Income

This requires a bit more investment knowledge or hiring licensed professionals. Portfolio income is income generated from income producing assets. Examples include equity stakes, business ownership, intellectual property portfolios, investment funds and private equity. These have the potential for the highest wealth ceiling out of all the income types, they are inflation resistant and they can be transferred and inherited as well.

9. Honorable mention: Platform Mediated Income (Social Media)

Most social media income is not royalty income, because creators do not control distribution or enforcement. Platforms pay creators based on engagement, not ownership. It is not based strictly on number of plays or views usually and each platform has their own formulas that change regularly to calculate payment to creators.

My humble advice is to find ways to move away from active income and start figuring out ways to monetize content where you’re doing things you do already or want to do. Be consistent, use multiple platforms, make clips of long videos to cater to those with shrinking attention spans and have a standard recognizable brand and good editing. Many freelancers don’t charge much for standard editing if you are not computer savvy or just want to focus on creating the content.

Summary

Finding the right mix of income types can lead to freedom from debt as well as time freedom. Self actualization is a need often neglected because we were taught to view it as a want but it is very necessary. When you view being fulfilled as a NEED, it changes your mentality. How you plan everything that follows this shift would then factor this in as a non-negotiable. Let’s get that bag!